Hiring permanent IT & business talent is hard right now

It takes forever, it’s expensive and it’s impacting businesses across the country.

Less than two years ago, recruiting for a permanent IT role would take around 8-13 weeks. Now, it can take anything from 3 months to a year – if you’re lucky.

You’re spending a fortune on recruitment, you have projects that you’re waiting to get off the ground, client targets to meet, maybe losing valuable staff – and no talent to do the work, replace leavers or to scale your business.

Sound familiar?

The good news is: it’s not you, it’s the market. Covid changed everything – and when markets change so seismically, there’s only one option: change your strategy. If you’re doing what you’ve always done and wondering why it’s not working, this guide will help you understand the current landscape and learn what to do next

We’ll explain why recruiting permanent staff has become hard, and how, with the right approach, you can do more than just alleviate the pain – you can turn this obstacle into an opportunity for business growth.

Hope you find it useful.

Thanks for reading.

How Did We Get Here?

The quick answer

- The end of lockdown created a surge in demand for new hires

- COVID and Brexit have shortened the supply of talent

- This created wage inflation, which is incentivising companies to make eye-watering counteroffers to hold onto staff and talent to sit tight as the offers they’re getting increase month-by-month

Covid

We all know what happened when Covid hit. The world stopped. Projects were halted, jobs were lost, recruitment was the last thing on anyone’s mind.

Companies weren’t thinking about growth. They were thinking about survival. This was an unprecedented, unpredictable period that led businesses to effectively hibernate, creating stasis in the job market.

A year later, when the economy began to reawaken, recruitment became the top priority – for everyone, at the same time. After a year and a half of redundancies and a freeze on recruitment, everyone had the same plan: recruit and rebuild.

This created a surge in demand unlike anything the UK job market had ever seen. And it happened to coincide perfectly with…

Brexit

As the end of lockdowns created a surge of demand for talent, Brexit shortened the supply. European workers left the UK as a direct result of Brexit, and others returned to their home nations during the pandemic.

Tighter work visas were also introduced. Until this time, the UK was a desirable place to work; it was easy regarding visa legislation, and there was a good supply of well-paid roles.

Almost overnight, the stream of skilled IT candidates from across the globe all but dried up. Now, although not impossible, it’s both more complicated and more expensive for companies to recruit internationally.

To give you an example: We recently filled a role for a company that was hiring for a well-paid technical lead role. In order to do this, the company’s only option was to sponsor their recruit’s visa, bringing the cost of hiring them to £15K. When you include the £10K recruiter’s fee, you’ve spent £25k on hiring one candidate before you’ve even paid your new hire a single penny.

The human element

The pandemic hasn’t just affected markets and economies. The landscape created by the past two years has had a knock-on effect on individual behaviours. Many candidates thinking about leaving their jobs have instead decided to hold fire, fearful of the unpredictable landscape.

Others tell recruiters they want to leave and then do nothing. They’re ready to resign but also fearful of leaving during these uncertain times.

All of these factors have contributed to a ‘sticky job market’; a market that doesn’t know whether it’s coming or going, and one that’s resistant to change. There’s plenty of opportunity, lots of conversations, interviews, and job offers but very little real movement or completion.

There are pay rises of 10 per cent, 15 per cent which weren’t happening a few months ago. Suddenly pay is spiking in lots of different industries. – The Financial Times

What impact is this having?

Candidates, rates and roles

What do you get when you have spiralling demand and tightened supply? You get inflation. The current imbalance in the market is fuelling the hyperinflation of wages, which is only exacerbating the backlog of open roles.

Over the past year, we’ve seen some IT permanent roles go up by 20/30% (in somes cases 40%) – and we’re talking about the same job with the exact same spec. When you look at the figures, it’s easy to see how this landscape benefits IT specialists. Candidates have their pick of jobs and can demand huge wages – and the wages they’re being offered are increasing.

Companies want to avoid recruiting for roles, or losing staff, so they’re prepared to pay over the odds to retain their talent. The market rates are so inflated that they know they’ll lose workers if they don’t match – or exceed – what’s out there. These counteroffers are incentivising employees to sit tight.

For example, if you’re a technical architect your salary has probably gone up by £10k over the last six months just by staying put. Just a hint that you might leave is enough to trigger an immediate pay review. It’s the career equivalent of wanting to move home but knowing that for every month you stay, your property will increase in price.

The problems for companies

How can you grow your business without the right people in the right roles? You can’t, it’s that simple.

It’s the equivalent of designing a beautiful building and having no one to build it. You may have grand plans for growth and a receptive market but to make it happen, you need talent.

The slow Covid months have created a surge of demand in the economy which should translate to a boom in business growth. Instead, companies are being forced to turn down clients, pause internal projects and scale back instead of scaling up.

Without the ability to grow, businesses have their hands tied; the shortage of talent is prohibiting everything from transformation and innovation to growth and expansion. What should be a period of substantial success is actually a period of crippling frustration: you see the opportunities but you can’t reach out and grab them.

This sticky recruitment market will certainly change at some point in the future, but what happens in the meantime? How long can businesses tread water and stay afloat?

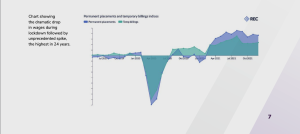

This month’s unprecedented increase in starting salaries – the highest in 24 years – is being driven by the near record fall in candidate availability – KPMG, UK Report on Jobs

The opportunity

This might sound bleak but don’t worry, we’re getting to the good bit. Problems often hide opportunities – and this one is no exception.

Everyone else may be in stasis trying and failing to fill permanent roles, but you don’t have to be.

A combined strategy of hiring contract staff to run alongside your permanent recruitment activities, will keep you moving forward.

Businesses have always used IT contractors to boost their workforce and achieve growth when perm hires aren’t the right solution. So why aren’t companies doing it now, when they need them more than ever?

There’s one big reason: IR35. The perceived hassle and cost of using contractors – not to mention fear of getting stung by the IR35 tax rules – is stopping companies from fixing their recruitment problems.

250,000 The number of IT contractors who are available to pick up projects in the UK.

But how long are companies willing to wait? One year, two years?

Eight months into this post-pandemic world, demand shows no signs of slowing. It’s actually continuing to increase. At best, the market might return to some sort of normality by 2025 – but even that’s a hopeful guess. We believe it’ll be at least two years before we see any significant adjustment in the market.

If you’ve been trying to fill a role for 9 months, what are your options? Go even higher with your salary offer? Outsource the work abroad? Spend even more on your recruitment drive with no guaranteed outcome?

This is a situation that gets worse the more senior you go. As the roles get more senior, the talent pool shrinks. You offer more money to your candidate and while they’re working their three-month notice, their employer outbids you. And now you’re back to square one.

It’s an exhausting, self-perpetuating problem – and it’s not going to change any time soon.

Meanwhile, the contract market is sitting there, untapped: a quarter of a million skilled contractors who have the power to plug your IT talent gap.

What to do

Why are contractors an attractive option?

Contractors are a flexible, ready-made workforce. In the UK we’re lucky to have a contractor market that is well-established and highly skilled.

If you want to get projects off the ground or create change within your organisation, IT contractors can make it happen – and you won’t have to wait six months to get going.

Contractors are easy to hire and quick to get started. A permanent position that takes you six months to recruit for in the current climate could be filled by a contractor in two weeks. That’s no exaggeration.

They’re used to hitting the ground running; they’ve chosen to be freelance and like to work agile and independently. And while they were once considered expensive, the current market inflation for permanent roles has closed the gap.

- Available

- Can start within two weeks

- Work independently

- Highly-skilled

- Competitively priced

- IR35 compliant

The misconception is that compliance is complicated and that you’ll be caught out by HMRC. The truth is that IR35 rules are actually clearly defined and easy to follow when you know how to do it.

Take Control of IR35

Whether you’re hiring inside or outside IR35, our ContractComplete service gives you no risk, hassle-free solutions that guarantee peace of mind, value for money and compliance with HMRC.

Getting IR35 right

Although managing IR35 is not as daunting as it first seems, if you want to hire a contractor, you do need to take the time to understand how it works. As the end client, it’s your responsibility to correctly determine a contractor’s IR35 status.

Inside IR35

Being inside IR35 means that HMRC would categorise the service your contractor is providing as employment, rather than self-employment. In this case, the contractor would be on PAYE; you would be responsible for deducting their tax and NI. This will cost your company more money than hiring outside IR35.

Outside IR35

Being outside IR35 means that your contractor is deemed self-employed. You would pay them a day rate, leaving them responsible for their own tax return and NI. Prior to the legislation changes, all contractors were paid in this way: you spent less, and they earned more.

How to determine a contractor’s status

Establishing the IR35 status of a contractor is largely based on how your organisation is structured and how you manage projects. It’s about determining whether or not a contractor is working as an independent provider of services or being treated in a similar way to an employee. There are a number of key factors to consider:

- Supervision, Direction and Control

- Substitution

- Mutuality of Obligation

- Financial Risk

For a contractor to be deemed outside IR35 (responsible for their own tax and NI contributions), all of these deciding factors need to be absent.

Let’s take a closer look at them:

Supervision, direction and control: Is someone overseeing the work a contractor is doing? Are they being assisted, guided or taught new skills to help them complete the work? Are they being given regular instructions and advice about how the work should be undertaken? Do you have control over the contractor’s work, their hours, and their place of work? Can you move the contractor on to different projects within the company?

Substitution: If a contractor cannot fulfil their duties, can they send a substitute to do the work? Has this ever happened? Can the hiring company reject this substitute if they wish to?

Mutuality of Obligation: Is there a binding commitment on the contractor or hiring company to provide/offer work?

Financial Risk: Has the contractor taken on any major financial risk as a result of working for your company? For example, have they invested in the company or bought any equipment or tools to do the work? Are you, the company, responsible for repairing/ managing any substandard work?

If the answer is yes to any of these questions, your contractor would be deemed inside IR35.

To be outside IR35, your contractor must be genuinely working independently: you give them the brief and the deadlines and effectively leave them to it. You shouldn’t be managing any aspect of how they deliver the end product. As a contractor, they should be using their own equipment and fully responsible for repairing any defective work. There should be no obligation from either party to continue with the partnership after the project has concluded.

What tools can you use to determine IR35 status?

When the tax legislation changed, HMRC provided an online tool (CEST) for determining tax status. Unfortunately, it quickly became apparent that this tool was inaccurate and, in some cases, had wrongly determined a contractor’s IR35 status.

The best way to determine a contractor’s status is by using the parameters above. It’s a question of how you manage your contractors.

If you’re struggling, you can work with an IR35 expert (like Identifi Global) to help you work it out.

What happens when IR35 status is confirmed?

Once you’ve determined a contractor’s status, you have four options:

- Inside IR35: Option 1 – Accept the status and pay more to cover the costs.

- Inside IR35: Option 2 – Make changes to the way you manage your contractor in order to push them outside IR35.

- Outside IR35: Option 1 – Accept that your contractor is outside IR35 and that there are potential risks (HMRC could query this).

- Outside IR35: Option 2: Make changes to the way you manage your contractor in order to push them inside IR35 so the risk is eliminated.

How do you decide?

Making this decision is often the trickiest part. It’s mostly down to your risk profile.

Your contractor may be clearly outside IR35, but for many businesses, there’s still a fear that they’ll somehow be caught out and hit with a huge fine. Should you take the risk-free, more expensive option and push them inside IR35? How big is this risk in reality? What would the cost of potential non-compliance be compared to the cost of bringing them inside IR35?

We have the tools and experience to guide you through this process and make sure your solution is fully compliant, regulated and indemnified. As well as compliance with HMRC rules, we can help you find a solution that fits within the boundaries of your organisation’s appetite for risk.

Ultimately, it comes down to peace of mind: we can help you make the right decision for your business and avoid unnecessary risk.

Reducing risk

One of the easiest ways to mitigate against IR35 risk and have peace of mind is by hiring an advisor. While contractors are often clued up about IR35, hiring managers aren’t always as well versed. That’s fine; you don’t need to be an IR35 expert, you just need to work with someone who is – and it’s not just about IR35.

From finding the right specialist to setting up contracts and navigating contract law, we help our clients with every aspect of hiring contractors. The new legislation means that if we get it wrong we’re just as liable as you, so it’s in everyone’s interest to ensure we get it right.

Whether your contractor falls inside or outside IR35, their tax status will inform how you’ll work together, and what you can realistically expect from them.

Our Contract Complete IR35 solution uses a contractor’s IR35 status as a basis to navigate everything from contracts to management. It’s designed to cover everything from setting up payroll, reviews and appraisals (inside IR35) to setting deliverables, verifying insurance, measuring success, and ensuring contractor responsibility for work (outside IR35).

With the right application, IR35 can actually be an effective business tool. Navigating it correctly will not only help avoid the obvious legal risks, but will also help to ensure the smooth running and completion of your projects.