Episode 13: Pete Sanders & Simon Farthing Commercial & Marketing Director at LexisNexis

In Episode 13 of The People First Podcast, Pete Sanders- Co-Founder and Group MD at Identifi Global- gets together with Simon Farthing, Commercial & Marketing Director at LexisNexis. The People First Podcast puts tech companies who recognise the value of great people in the spotlight; LexisNexis, a legal tech & legal services…

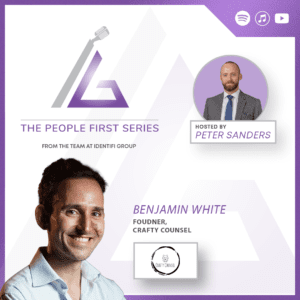

Read More »Episode 12: Pete Sanders & Benjamin White Founder of Crafty Counsel

Episode 12 of The People First Series is not one to be missed! Peter Sanders virtually sits down and chats with Benjamin White, the Founder of Crafty Counsel, about helpful lockdown communication tools, how to be an empowering leader and all things personal development. Crafty Counsel is a media company operating in the…

Read More »IR35: What are my options as a Contractor after April 2021?

The IR35 reforms, which already apply to the public sector and which come into play for all private businesses in April 2021, signify enormous changes to employment tax regulations. With potentially hefty financial penalties for non-compliance, it is vital that Contractors who haven’t yet prepared for these regulation changes put plans in place…

Read More »Episode 11: Helen Thorne & Amiqus duo Lisa Mahoney & Richie Stewart

For Episode 11 of The People First Series, Helen Thorne sits down (digitally, of course!) with Amiqus duo Lisa Mahoney, Growth Marketing Lead, and Richie Stewart, Head of Client Management, for an in-depth chat about the challenges of remote working. Being a small tech company, Amiqus managed to move their team online relatively…

Read More »IR35: What do employers need to do before April 2021 – Part 3 (webinar)

With IR35 fast approaching, IR35 expert Paul Lloyd and identifi Global MD Pete Sanders highlight some of the hidden issues businesses may not be aware of once they have have completed IR35 audits on their flexible workforce. • Brief recap of IR35 and what you and your client should be doing • SoW and…

Read More »Episode 10: Peter Sanders, Gary Fay, Jed Stone (Issured) & Jill McTigue-Battley (Former New Scotland Yard)

In Episode 10 of The People First Series, Pete Sanders – Co-Founder and Group MD at Identifi Group – and Gary Fay – CEO at Identifi Group – are joined by two very special guests. The first is Jed Stone, Director at Issured, Identifi Group’s consulting partner. Jed joins us to talk about…

Read More »